What will you learn through this module?

- The cost of capital is the price at which a business must borrow money or pay out equity, or from the perspective of an investor.

- It establishes a standard that new projects must fulfil and is the minimum return that investors anticipate in exchange for their investment in the company.

- Company executives use the cost of capital to determine how much revenue new ventures must earn to cover start-up costs and turn a profit.

- Investors and analysts place a great deal of importance on the cost of capital.

Introduction

The cost of capital is the price at which a business must borrow money or pay out equity, or from the perspective of an investor, it is "the required rate of return on a portfolio company's existing securities." It is employed by businesses to assess new projects. It establishes a standard that new projects must fulfil and is the minimum return that investors anticipate in exchange for their investment in the company.

Company executives use the cost of capital to determine how much revenue new ventures must earn to cover start-up costs and turn a profit. They also utilize it to assess the risk associated with upcoming business decisions. Investors and analysts place a great deal of importance on the cost of capital.

These organizations make use of it to estimate stock prices and potential profits from purchased shares. For instance, if a company's financial statements or cost of capital are unstable, the price of shares may drastically decline, which may cause investors to withhold their financial support.

Learning Objectives

- Recognise the various financing options a corporation may choose from, including debt, equity, and hybrid equity.

- Recognise the debt and equity parts of the weighted average cost of capital (WACC) and explain how the WACC was adjusted and the tax ramifications of debt financing.

- Determine the component weights based on book values or market prices.

- Describe the WACC's role in capital budgeting models and how to calculate a project's beta to solve capital budgeting issues.

- Choose the best project combinations for the approved possible projects in a company's portfolio.

Understanding Cost of Capital

The cost of capital is essential data used to calculate a project's hurdle rate. Before starting a major project, a business must estimate the revenue it will need to bring to cover its costs and sustain future profits.

The return anticipated from purchasing stock shares or making any other investment is evaluated from an investor's viewpoint by the term "cost of capital." This is an estimate, so best- and worst-case scenarios may be included. An investor may consider the volatility (beta) of a company's financial results to decide whether a stock's price is reasonable given its possible return.

- Cost of capital is the profit a business must make to cover the cost of a capital project, such as buying new machinery or building a new structure.

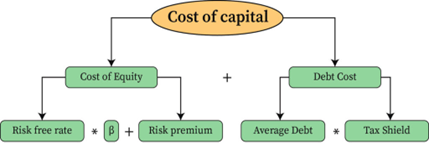

- The cost of capital includes both stock and debt costs and is weighted based on the company's preferred or current capital structure. The weighted average cost of capital (WACC) is this.

- When a corporation decides to engage in a new project, the return it expects to receive must always outweigh the cost of the money it utilizes to finance the initiative. Otherwise, the project won't give investors a return.

Cost of Debt

The interest expenses you incur on whatever loans your company has taken out are the cost of debt (or debt cost). If you have multiple loans, you will combine the interest rates to get the total cost of the debt for your business. A company may use either debt-and-equity financing or equity financing. In the former, a financier, typically a venture capitalist or angel investor contributes working capital in return for a share of the company's equity or ownership.

A firm's debt cost will depend on the annual interest rate on the capital it borrows or the total amount of interest it will pay. The interest rate loan providers will charge a business is determined by factors like the company's financial health and credit rating. Higher credit scores make businesses appear less dangerous to lenders, and lenders find it simpler to offer less risky borrowers reduced interest rates.

There are various methods for calculating the cost of debt depending on whether you're looking at it pre-tax or post-tax. You can determine your pre-tax cost of debt:

Cost of debt=Total InterestTotal Debt

However, you can frequently save on taxes if your loan interest costs are deductible. Calculating the post-tax cost of debt is helpful in this situation. You must be aware of your effective tax rate to achieve this. Any tax costs at your corporate tax rate are included in the cost of debt:

Effective Interest Rate*(1 -tax rate).

Cost of Preference Share

The cost of preference share capital is the portion of the cost of capital in which we compute the amount payable to preference shareholders in the form of a fixed-rate dividend. The firm's board of directors may want to pay a dividend to a preference shareholder even though the preference shareholders cannot compel the corporation to do so.

Companies can also raise money by issuing preferred share capital. Due to two fundamental characteristics, preference share capital differs from equity share capital.

- In the event of a company's liquidation, the preference shareholders will get the capital repayment in preference to the distribution among the equity shareholders.

- The preference share is entitled to receive dividends at a specified rate in precedence over the equity shares.

Due to the fact that the preference dividend is only paid when there is enough profit, the company is not required to pay it. The business also seeks to distribute dividends to stock investors.

Contrary to interest on debentures, which is a charge against profits, the preference dividend is anticipated as an appropriation of profit. It may be claimed that there is no cost of preference share capital to the company because the payment of the preference dividend is not contractually required of the corporation.

As the preference shares may either be redeemable or irredeemable, the Cost of capital may also be ascertained accordingly.

REDEEMABLE SHARE

If the preference share is redeemable at the end of a specific period, then the Cost of the capital of preference shares can be calculated by equation.

KP = DP + ((RV-NP)/n)/ (RV+NP)/2

Where,

KP = Cost of Preference Share

DP = Dividend on preference share

NP = Net proceeds from the issue of preference share (Issue price – Flotation cost)

RV = Redemption Value

N = Period of preference share

IRREDEEMABLE SHARE

In case of an irredeemable preference share, the Dividend at the fixed rate will be perpetually payable to the preference shareholder. The Cost of capital of the irredeemable preference share can be calculated with the help of the equation.

KP = PD/ Po

Where,

PD = Annual preference dividends

Po = Net Proceeds on the issue of preference shares

Kp = Cost of capital of preference shares.

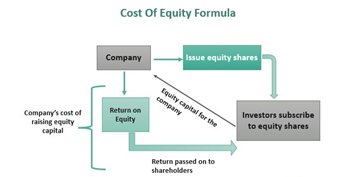

Cost of Equity Capital

The cost of equity share capital represents the portion of a company's overall cost of capital that is specifically attributable to equity shareholders. Equity shareholders invest in the company by purchasing shares, expecting to earn a return on their investment. From the company's perspective, the cost of equity share capital is viewed as an expense that must be incurred to attract and retain investors. The company needs to generate a return that surpasses the cost of equity capital to preserve or enhance the market value of its shares.

Various methods are available for calculating the cost of equity capital, each with its unique approach and formula. Let's explore these methods in more detail:

- Dividend yield method or Dividend Price ratio method:

Ke = DPS / MPPS or NPPS

Cost of Equity Capital = Dividend per equity share/ Market price or net proceeds per share

The dividend yield method determines the cost of equity capital by dividing the present value of projected future dividends per share by the current market price or net proceeds per share. This calculation allows for an assessment of the cost of equity capital, considering the relationship between expected dividends and the prevailing market price or net proceeds per share.

- Dividend yield plus growth in dividend method:

Ke = DPS / MPPS or NPPS + G%

Cost of Equity Capital = DPS/ MPPS or NPPS + Rate of growth in dividends

This method considers the growth prospects of the company and adds the growth rate in dividends to the cost of equity capital calculated using the dividend yield method. It recognizes that shareholders expect additional profits due to the company's growth.

- Earning yield method:

Ke = EPS / MPPS or NPPS.

Cost of Equity Capital = Earnings per share / Net proceed or Market price per share

In the earning yield method, the cost of equity capital is derived as the minimum rate of return necessary on the market price of a share. This rate is calculated by dividing the earnings per share by the net proceeds or market price per share. Using this formula, companies can evaluate the cost of equity capital based on the earnings generated concerning the net proceeds or market price per share.

- Realized yield method:

Ke = Actual Earnings per Share / Market price per share X 100

Cost of Equity Capital = Actual earnings per Share / Market price per share X 100

The realized yield method overcomes the limitations of the dividend yield and earning yield methods, as it relies on the actual earnings generated from the entire investment amount. It considers the proportion of funds financed by equity share capital and reserves from past profits to compute the cost of equity share capital.

By utilizing these methods and their corresponding formulas, companies can estimate the cost of equity capital.

In summary, the cost of equity share capital is a significant factor for companies to consider, as it represents the expense associated with compensating equity shareholders. Companies have a range of methods at their disposal to calculate the cost of equity capital, including the dividend yield method, dividend yield plus growth in dividend method, earning yield method, and realized yield method. These methods offer valuable insights into the expected returns and requirements of shareholders. By employing these techniques, companies can assess the cost of equity capital and make informed decisions regarding the returns needed to satisfy investor expectations.

Cost of Debt vs. Equity

Particulars

|

Cost of Debt |

Cost of Equity |

|

|

Source of Financing |

Borrowed funds from lenders (creditors) |

Funds raised by selling ownership shares (equity investors) |

|

Nature of Payment |

Fixed interest payments |

Variable returns in the form of dividends and capital appreciation |

|

Claim on Assets |

Priority claim (senior to equity) |

Residual claim (after debt holders and other obligations) |

|

Risk Profile |

Lower risk (debt holders have priority in repayment) |

Higher risk (equity holders bear residual risk) |

|

Determination |

Agreed interest rate based on debt agreement |

Estimated return based on investor expectations, market conditions, and company's risk |

|

Tax Benefit |

Interest payments are tax-deductible |

Dividends are not tax-deductible |

|

Impact on Financial Structure |

Increases leverage and interest expense |

Increases shareholders' equity and dividend obligations |

|

Impact on Control |

Does not dilute ownership or control |

Dilutes ownership and may impact control |

It's important to note that the cost of debt and the cost of equity are both essential in determining a company's overall cost of capital, which represents the average cost of financing the company's operations. The relative proportions of debt and equity in a company's capital structure impact its overall risk and financial health.

Cost of Retained Earnings

In the realm of corporate finance, it is not uncommon for companies to hold back a portion of their profits rather than distributing them outright to their shareholders as dividends. Surprisingly, some individuals harbor the misconception that these retained earnings come without any associated costs. However, this belief needs to be revised since shareholders could have reaped financial gains had the company chosen to distribute the earnings. By holding onto a portion of the profit, the company inadvertently denies shareholders these potential earnings, resulting in what is known as an opportunity cost.

To put it differently, the cost of retained earnings can be seen as the income forgone by shareholders had they chosen to invest the funds elsewhere. For instance, if shareholders had directed the funds into alternative ventures, they might have garnered a handsome 10% return. The company precludes shareholders from enjoying this 10% return by opting not to disburse the entire profits. Consequently, the estimated cost of retained earnings can be pegged at 10%.

Kr = Ke(1-T) (1-B)

Where,

Kr= Required rate of return on retained earnings.

Ke= Shareholder’s required rate of return.

T= Shareholders’ marginal tax rate.

B= Brokerage cost.

- The opportunity cost of retained earnings is determined by considering the hypothetical actions shareholders would have taken with dividend payments, such as investing in equity shares.

- Shareholders do not receive the total amount of retained earnings due to taxes and expenses like brokerage fees, reducing their available funds.

- The funds received by shareholders fall short of what they would have obtained if the company had distributed the earnings, leading to a lower cost of retained earnings than issuing new equity shares.

Retained earnings should not be perceived as devoid of costs for shareholders. The price of retained earnings reflects the lost potential earnings that shareholders could have accrued if the funds had been disbursed as dividends or invested elsewhere. Although determining the actual cost of retained earnings can be intricate due to multiple factors at play, contemplating the opportunity cost and potential returns provides valuable insights into the impact of maintaining earnings on shareholders and the overall cost of capital for the company.

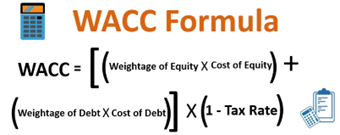

Weighted Average Cost of Capital

- Weighted Average Cost of Capital (WACC) is a financial metric used to assess funding costs for companies with a mix of debt and equity.

- WACC calculates the average cost of capital based on the proportions of debt and equity in the company's capital structure.

- Finance professionals widely use them in various roles, such as investment banking, private equity analysis, and corporate finance.

- In M&A activities, WACC helps determine business value through discounted cash flow (DCF) analysis.

- It can be used independently to evaluate the attractiveness of investment opportunities.

- WACC calculation involves two main components: multiplying the weight of equity by the cost of equity and the importance of debt by the cost of debt.

- Determining equity value can be challenging due to market price fluctuations, introducing uncertainty into WACC accuracy.

- WACC guides companies in determining the price of external funds in their business ventures.

- Reveals the minimum rate of return necessary to satisfy shareholder and lender expectations.

- Unveils the cost of accessing external resources, ensuring a harmonious relationship between shareholders and lenders.

- Empowers companies to assess the viability of utilizing external resources and achieve financial prosperity.

- The WACC formula unravels the mysteries of financing and showcases the intricate interplay between debt and equity.

- It enables companies to determine the minimum rate of return required to reward shareholders and meet lender expectations.

Calculation of WACC

Critical components in calculating WACC include:

- Market Value of Equity (E): This represents the market capitalization of a company, calculated by multiplying the number of outstanding shares by the current share price. Private companies often estimate the value of equity through comparable company analysis.

- Market Value of Debt (D): This can be estimated based on a company's reported debt totals in recent balance sheets.

- Cost of Equity (Re): The cost of equity is the minimum rate of return demanded by shareholders. It can be determined using historical standards, shareholder agreements, or the capital asset pricing model (CAPM), which considers the company's risk tolerance and market risk.

- Cost of Debt (Rd): While existing interest rates on debt technically represent the current cost of debt, WACC is a forward-looking calculation. Therefore, using the average yield to maturity (YTM) on long-term debt provides a more accurate estimate. The company's credit rating can also be used to estimate the cost of debt.

- Corporate Tax Rate (Tc): Since interest payments are tax-deductible, the debt cost must be adjusted accordingly. The corporate tax rate, which varies based on the company's location and applicable tax laws, is applied to account for this tax advantage.

In summary, WACC is a vital tool for evaluating the cost of funding for companies with mixed debt and equity capital structures. By considering the proportions and associated costs of equity and debt, WACC provides insights into the overall cost of capital and assists in decision-making regarding investments and financial strategies.

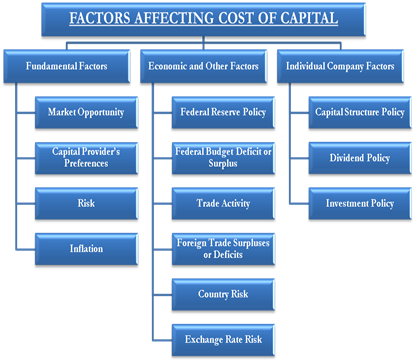

Factors Affecting the Cost of Capital

When a company seeks to acquire funds from external sources, it must consider its cost of capital. These funds can be obtained through shares or debt. Debt financing entails the payment of interest, while equity financing requires dividend payments to shareholders. To establish an optimal cost of capital model that minimizes expenses, it is crucial to examine the factors that affect the cost of capital.

The following are the key factors that influence the cost of capital:

- Current Economic Conditions

The prevailing economic conditions play a significant role in determining the cost of capital. Banks may offer loans at lower interest rates in a flourishing economy to stimulate sales and ensure product stability. Consequently, the company's cost of debt, which is a component of the overall cost of capital, decreases. However, it is essential to note that the general economic climate impacts the cost of capital. During a severe market recession, financial institutions are unlikely to reduce interest rates as they need to generate returns for their customers. This means that loan providers also have their own cost of capital. In a stable market environment, the cost of debt decreases while the cost of equity capital increases.

2.Current Capital Structure

When considering an optimal capital structure, it is necessary to analyze the cost of capital. However, studying the current capital structure can also influence the cost of capital. The current debt-to-equity ratio has an impact on the cost of capital. If the proportion of debt exceeds that of share capital, the cost of debt will be higher. Conversely, if the ratio of share capital surpasses that of debt, the cost of equity or preference share capital will prevail.

3.Current Dividend Policy

Every company must establish a dividend policy that determines the amount of earnings allocated for dividend payments. The Price-Earnings Ratio (Dividend/EPS) is a key metric used in this regard. An increase in the Price-Earnings Ratio results in a decrease in the cost of retained earnings. This is because less money is included, which can be utilized to promote business growth and serve as a source of funds.

4.Acquisition of New Funds

The requirement for new funds also influences the cost of capital. If a company urgently needs US$20 million for business expansion, it may be subject to higher interest rates due to increased risk for financial institutions. Loan providers exercise caution and thoroughly analyze a company before granting significant loans. Immediate access to a large loan generally results in higher returns for the lender, leading to increased costs for the company. Additionally, each time a company seeks funds from the market, it is subject to prevailing market rates, which may either increase or decrease its current cost of capital.

5.Financial and Investment Decisions

The financial and investment decisions made by a company have a direct impact on its cost of capital. When acquiring new share capital or debt, it is necessary to inform fund providers about the intended use of their funds. Higher-risk investments typically yield more significant rewards for both shareholders and creditors. Therefore, the company's financial and investment decisions influence its cost of capital.

6.Current Income Tax Rates

Interest charges are deducted before tax obligations are met. High tax rates affect the cost of share capital because they reduce net earnings, resulting in lower earnings per share and, consequently, lower dividend payments to shareholders.

By carefully considering these factors, a company can gain a deeper understanding of the various elements that shape its cost of capital. This knowledge enables informed decision-making and the formulation of effective strategies to optimize the cost of capital and enhance overall financial performance.