Market Alert: Trump-Xi APEC Summit a Critical Test for Global Trade Stability

1. ASX Outlook-

The ASX 200 index, which tracks the top 200 companies on the Australian Securities Exchange, is trading around 9,008, down 4 points or -0.05%. So, it’s basically flat — showing a bit of hesitation after a mixed lead from the U.S.

2. Overnight US Markets:

So, overall, Wall Street was mostly positive, led by tech strength.

3. US Sector Performance

Winners:

Tech stocks surged — Information Technology +1.64% was the top performer.

Losers:

On the downside, Real Estate (-2.22%), Utilities (-1.66%), and Energy (-1.05%) lagged.

We’re seeing a tech-led rally overseas but weakness in defensives and energy, which often mirrors local trading patterns

4. Commodities

This means we might see pressure on local energy and mining names today.

5. What to Watch Today (ASX Focus)

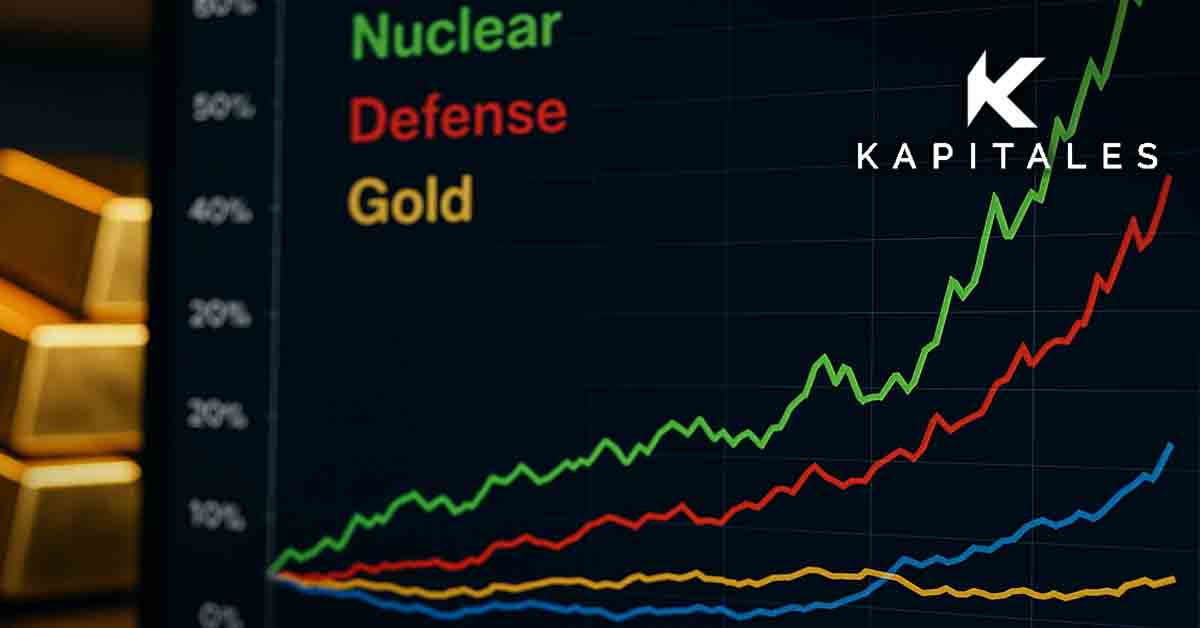

Uranium stocks could be strong after the U.S. announced an $80 billion nuclear expansion deal with Brookfield and Cameco, aimed at powering AI data centers.

Aussie inflation data will be closely watched.

IPO activity – two explorers are debuting today, both around 30 cents per share, and traders are watching CSL and Wisetech, which fell ~15% yesterday

6. Broker Move:

A couple of notable upgrades from JPMorgan:

These may give some upside momentum in the materials space.

7. Stocks Trading Ex-Dividend

Only two companies trading ex-dividend today:

Expect some mild price adjustments as these stocks lose their dividend value.

Our take at Kapitales Research:

A balanced start with lots of moving pieces, but overall sentiment remains cautious ahead of inflation data.

Customer Notice:

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.

Kapitales Research, Level 13, Suite 1A, 465 Victoria Ave, Chatswood, NSW 2067, Australia | 1800 005 780 | info@kapitales.com

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Oct 28, 2025

Oct 28, 2025

Oct 28, 2025

Oct 28, 2025

Oct 28, 2025

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.