Market Alert: Trump-Xi APEC Summit a Critical Test for Global Trade Stability

1. ASX Outlook-

The ASX 200 (XJO) is currently sitting around 8,891, down 34 points or 0.39%. So, the market has opened softer this morning, following a somewhat mixed lead from Wall Street overnight.

The sentiment across Australia and New Zealand is cautious — early trades suggest investors are digesting inflation news and waiting for clearer signals on rate cuts.

2. Overnight US Markets:

Overnight, the U.S. markets didn’t move much overall, but there were pockets of strength and weakness:

Fed cut rates by 25 bps as expected, Powell flagged “another rate cut in December not a foregone conclusion. Major US benchmarks mostly lower and dipped on Powell’s hawkish comments at the post-FOMC press conference.

So, tech continues to lead, but the broader market was mixed, especially after fresh inflation data rattled rate cut expectations

3. US Sector Performance

Winners: Tech and Communication Services both rose +1.05% — that’s where the strength was.

Losers: Real Estate (-2.66%) /Consumer Staples (-2.00%)

This shows investors are rotating back into growth and tech, while defensives and interest-rate-sensitive sectors took a hit.

4. Commodities

Now looking at commodities, it’s a bit of a mixed bag:

So, while gold softened, base metals and oil showed modest strength, which could lend some support to local miners and energy names.

Two big themes to keep an eye on today:

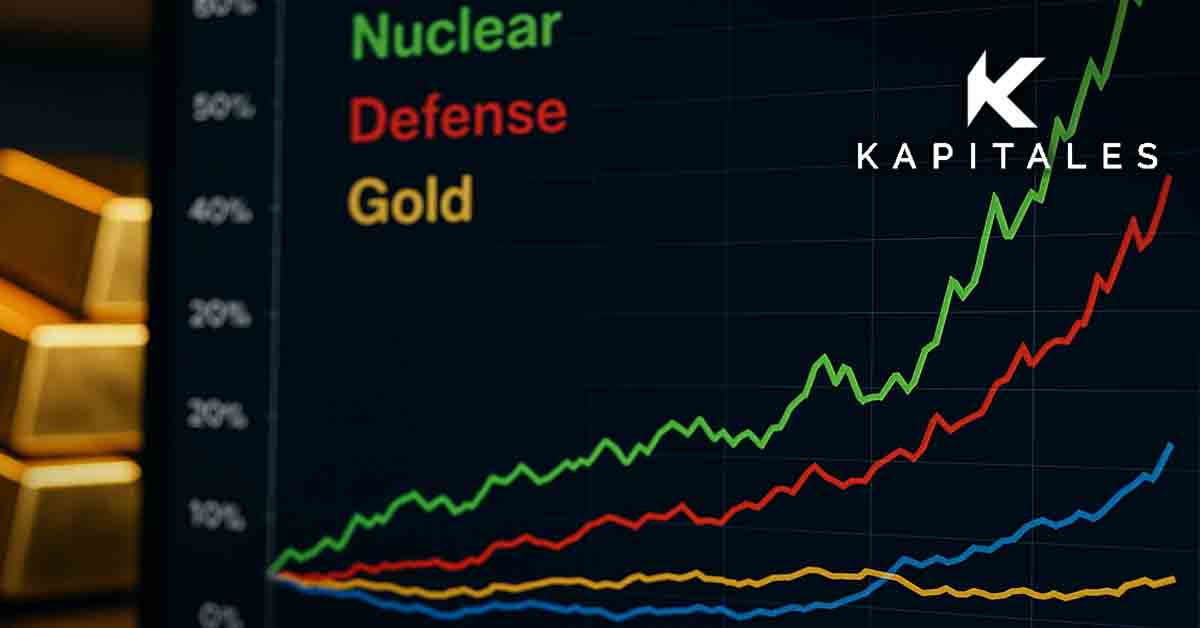

Uranium

Inflation Shock

In consclusion, inflation and rate outlook are the key themes driving market caution today.

Plenty of broker activity this morning — mostly upgrades from Macquarie (MQG) and JPMorgan (JPM)

A lot of optimism in the lithium and mining space here, suggesting brokers see value returning to these names.

7. Stocks Trading Ex-Dividend

A couple of companies are trading ex-dividend today:

That means their share prices might dip slightly to reflect the payout.

Our take at Kapitales Research:

We’ve got a soft open, inflation jitters, but still pockets of strength — especially in tech, uranium, and lithium.

It’s a day to stay selective, focus on quality names, and keep an eye on the rate outlook.

Customer Notice:

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.

Kapitales Research, Level 13, Suite 1A, 465 Victoria Ave, Chatswood, NSW 2067, Australia | 1800 005 780 | info@kapitales.com

Oct 30, 2025

Oct 30, 2025

Oct 30, 2025

Oct 30, 2025

Oct 30, 2025

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Oct 29, 2025

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.