Market Alert: Global Equity Markets Under Pressure Amid Valuation Concerns and Economic Uncertainty

1. ASX 200 Opens Higher:

The ASX 200 is trading up 0.16% at 8,850.10 (10:46 am AEDT), following a strong lead from Wall Street overnight. The index has now gained 0.41% over the past five sessions and sits 2.9% below its 52-week high.

Gains are being led by strength in Materials, Energy, and Consumer Discretionary, while Financials are providing a modest drag. Light & Wonder Inc. and Monadelphous Group Limited are among the session’s top performers, up 10.07% and 6.62% respectively, after upbeat earnings momentum and improved sector sentiment.

2. Wall Street Surges as Shutdown Hopes Lift Risk Sentiment

US equities rallied strongly overnight as optimism grew that a deal in the US Senate could avert a federal government shutdown.

Dow Jones: +0.81%

S&P 500: +1.54%

Nasdaq: +2.27%

The Nasdaq recorded its best session since May, driven by a rebound in large-cap tech and communication names. Progress in Washington boosted investor sentiment, with risk appetite returning across equities and commodities.

Big Tech outperformed: Nvidia (+6.1%), Alphabet (+4.0%), and Tesla (+3.7%) led gains, while the broader Information Technology (+2.68%), Communication Services (+2.53%), and Consumer Discretionary (+1.49%) sectors outperformed. Defensives such as Consumer Staples (–0.34%), Utilities (–0.12%), and Real Estate (–0.14%) underperformed as investors rotated back into growth...

3. Sector Performance — ASX

Nine of eleven ASX sectors are trading higher in early trade.

Leaders: Materials (+1.25%), Consumer Discretionary (+0.72%), Energy (+0.65%), Telecom Services (+0.73%)

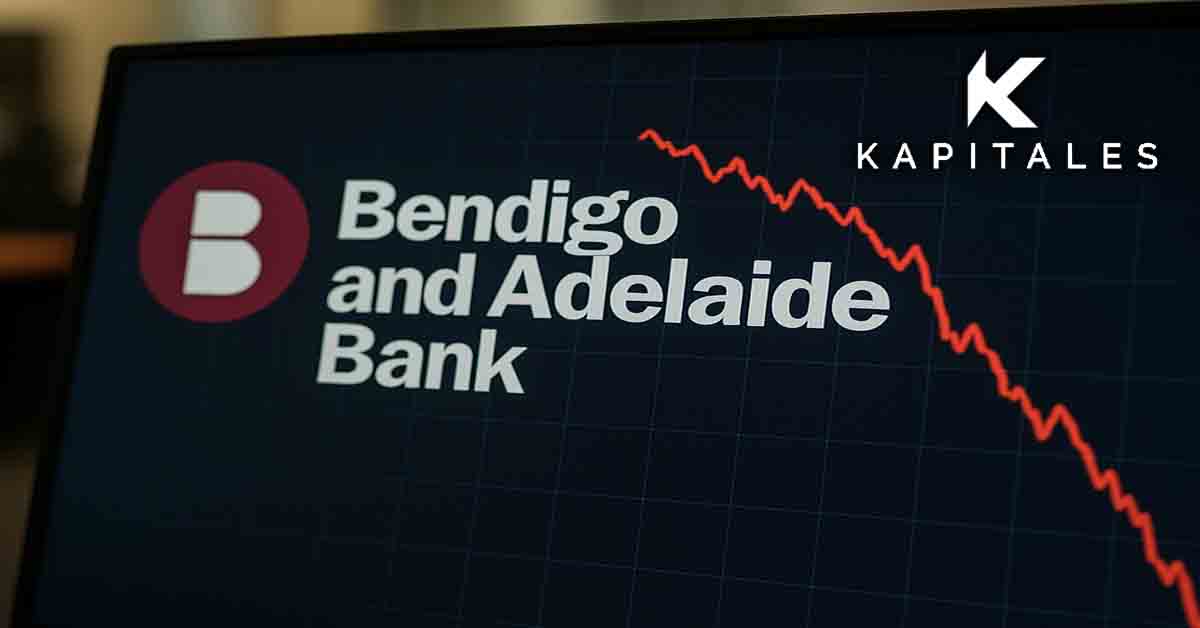

Laggards: Financials (–1.12%), Information Technology (–0.22%)

Materials are driving the gains as gold prices surged overnight. Utilities and Healthcare are also firmer, while Financials are seeing light profit-taking after recent strength.

4. Commodity Watch

Gold rose 2.7% to US$4,108/oz — its strongest level in several weeks — after JPMorgan Private Bank projected prices could climb above US$5,000/oz in 2026. The rally in precious metals lifted related equities, with Northern Star up 3.3%.

Silver advanced 4.6%, while Copper and Oil both firmed modestly.

The rebound in gold and base metals is helping to lift Materials and Energy sectors, which are expected to remain firm throughout the session.

5. ASX Corporate Highlights

Broker Moves:

Dividends Paid: Gowing Bros (GOW), Tasmea (TEA)

Ex-Dividend:

6. What to Watch Today

Resources: Gold and rare earth miners are expected to lead after overnight strength in metals. The Gold Miners ETF rose 4.7%, while Rare Earth ETFs jumped over 6%. Pilbara Minerals (PLS) and Lynas (LYC) are likely to remain in focus.

Market Sentiment: The rebound in US equities may mark the end of last week’s shallow pullback, with analysts turning optimistic on Q3 earnings and stronger corporate profit guidance.

Banks: CBA and Bendigo results could influence the broader financial sector as margins remain in focus.

7. Kapitales Research Take

The ASX 200 is trading higher for a second straight session, supported by strong overnight gains in Wall Street and firmer commodity prices. Materials are leading the local market, driven by gold’s rally and improving sentiment toward metals.

While Financials are weaker on profit-taking, the broader tone is constructive, suggesting the recent correction may be short-lived. We expect the ASX to hold gains around 8,840–8,870 through the session, with upside potential if US futures remain firm into the afternoon.

Customer Notice:

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.

Kapitales Research, Level 13, Suite 1A, 465 Victoria Ave, Chatswood, NSW 2067, Australia | 1800 005 780 | info@kapitales.com

Nov 12, 2025

Nov 12, 2025

Nov 12, 2025

Nov 12, 2025

Nov 12, 2025

Nov 11, 2025

Nov 11, 2025

Nov 11, 2025

Nov 11, 2025

Nov 11, 2025

Nextgen Global Services Pty Ltd trading as Kapitales Research (ABN 89 652 632 561) is a Corporate Authorised Representative (CAR No. 1293674) of Enva Australia Pty Ltd (AFSL 424494). The information contained in this website is general information only. Any advice is general advice only. No consideration has been given or will be given to the individual investment objectives, financial situation or needs of any particular person. The decision to invest or trade and the method selected is a personal decision and involves an inherent level of risk, and you must undertake your own investigations and obtain your own advice regarding the suitability of this product for your circumstances. Please be aware that all trading activity is subject to both profit & loss and may not be suitable for you. The past performance of this product is not and should not be taken as an indication of future performance.